‘Quic PIVC’ – Pre-Issuance Verification Calling Solution for Insurers

Our Next-Gen Verification Technology

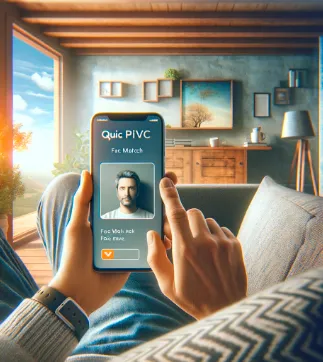

In today’s Insurance landscape, AI based, Pre-Issuance Verification Call (PIVC) stands as a transformative tool, redefining the policy issuance process with enhanced accuracy and security. Integral to modern insurance practices, ‘Quic PIVC’ ensures meticulous validation of policyholder identities, leveraging advanced technologies for a seamless and trustworthy experience. This innovative process includes robust PAN and Aadhaar verification through UIDAI and NSDA and impersonation check using the state-of-the-art face match technology, affirming the identity of customers against their official documents.

Our ‘Quic PIVC’ system is further distinguished by its cutting-edge consent verification process. Using sophisticated speech-to-text technology, it precisely compares the customer’s verbal consent against a predefined script, significantly reducing the need for manual oversight and elevating the integrity of the verification process. Additionally, the integration of Digilocker verification plays a crucial role, enabling secure checking of mobile number/aadhar linkage and identifying biometric lock status. Alongside geo-location verification and liveliness checks, our comprehensive ‘Quic PIVC’ tool not only bolsters the reliability of policy issuance, but also marks a new era in efficient, transparent, and customer-focused policy issuance.

Why PIVC?

PIVC (Pre-Issuance Verification Call) has emerged as a crucial element in reinforcing the integrity and trustworthiness of the insurance sector in India. This process plays a vital role in establishing iron-clad agreements between insurers and policyholders, ensuring a robust foundation for insurance contracts.

- Ensures Accurate Risk Assessment: PIVC allows insurers to verify critical information, ensuring accurate risk calculation for tailoring policies.

- Fraud Prevention: It acts as a crucial checkpoint to detect and prevent fraudulent activities, safeguarding both the insurer and genuine policyholders.

- Regulatory Compliance: By verifying policyholder details, PIVC ensures that insurance companies remain compliant with regulatory standards.

- Enhances Transparency: This process promotes transparency by clearly communicating policy terms and conditions to the policyholder.

- Builds Customer Trust: Through verification, PIVC fosters trust, as policyholders are assured of the insurer’s commitment to accuracy and transparency.

- Reduces Claim Disputes: Accurate information verification minimizes the chances of disputes over claims in the future.

- Multilingual Support: Addresses communication barriers by offering verification in multiple languages, catering to diverse policyholders.

- Addresses Incomplete Information: Proactively helps policyholders complete their applications correctly, reducing delays in policy issuance.

- Adapts to Technological Challenges: Utilizes advanced systems to overcome issues like poor connectivity, ensuring a smooth verification process.

- Cost-Effective and Efficient: Streamlines the policy issuance process, making it more cost-effective and efficient for both insurers and policyholders.

Our PIVC Solutions: Quic PIVC and Assisted PIVC

In today’s insurance landscape, the need for robust and versatile verification tools is paramount. Our offerings, Quic PIVC and Assisted PIVC, are designed to address this need, providing comprehensive solutions that complement each other, enhancing the verification process’s efficiency and reliability.

Quic PIVC: The Advanced AI-Driven Solution

Quic PIVC stands as a testament to technological advancement in the insurance sector. This AI-powered tool streamlines the pre-issuance verification process with features like:

- Automated Verification: Using AI to authenticate personal details against official documents like PAN and Aadhaar.

- Geo-Location and Liveliness Checks: Ensuring the physical presence of the policyholder and confirming their current location.

- Multilingual Support: Catering to India’s linguistic diversity by offering verification in multiple languages.

- Speech-to-Text for Consent Verification: Comparing spoken consent against predefined scripts, reducing the need for manual review.

- Digilocker Integration: Verifying telephone number and Aadhaar linkage and checking biometric lock status for added security.

Quic PIVC is ideal for policyholders comfortable with digital interfaces, offering a quick, seamless verification experience. Request a personalized walkthrough of our Quic PIVC tool now.

Assisted PIVC: The Human Touch in Verification

Recognizing that not all customers are equally tech-savvy, Assisted PIVC provides a more personalized approach. It involves trained professionals guiding policyholders through the verification process, ensuring clarity and completeness. Key features include:

- Personalized Interaction: Direct communication between the policyholder and a verification agent, aiding those who prefer human interaction or need assistance.

- Handling Complex Queries: Agents can address specific concerns or questions, providing a more tailored experience.

- Flexible Scheduling: Accommodating policyholders who require verification at specific times, especially beneficial for those in areas with connectivity issues.

- Comprehensive Verification: Ensuring that all aspects of the policy and policyholder information are thoroughly verified and understood.

Synergy of Quic PIVC and Assisted PIVC

The integration of Quic PIVC and Assisted PIVC in insurance verification offers a seamless, customer-centric approach. Quic PIVC provides an efficient, automated process, while Assisted PIVC steps in when technology meets limitations. This synergy ensures that if Quic PIVC encounters challenges—be it technical hiccups or a customer’s discomfort with digital tools—the process smoothly transitions to Assisted PIVC, preventing any loss of time or opportunity. This failover mechanism guarantees that every customer journey, regardless of technological proficiency, leads to successful policy verification. By blending advanced technology with personalized assistance, our approach ensures inclusivity, continuity, and enhanced customer satisfaction in the policy issuance process.

The ‘Quic PIVC’ Process: A Comprehensive and Multilingual Approach

Our ‘Quic PIVC’ process integrates cutting-edge technology and linguistic versatility to ensure a secure and inclusive policy issuance journey. Here’s an updated overview reflecting the full scope of our steps:

- Insurer Onboards Customer: The process commences with the insurer welcoming the customer, setting the stage for the policy verification.

- Customer Opens Weblink App: The customer engages with the process by accessing a dedicated web link to the PIVC application.

- Location & IP Check: The system verifies the customer’s location and IP address to authenticate the session’s legitimacy.

- ID Verification: Utilizing official documents, the customer’s identity is confirmed to match the details on record.

- Liveliness Check: A pivotal liveliness check ensures the customer is present and ready for the subsequent steps.

- Face Match: Following the liveliness confirmation, a face match test compares the customer’s live image to their ID photo, leveraging AI for precision.

- Full Photo Verification: The customer is then prompted to submit a full photograph, which undergoes an AI-based full photo check to verify the person’s identity comprehensively.

- Customer Records Video Consent: In any of the 11 supported Indian languages, the customer records a video consent, solidifying their understanding and agreement to the policy terms. Using our speech to text engine, we confirm that the consent is in line with the expectations.

- Process Data Sent to Insurer: The data, inclusive of the video consent and verification checks, is processed and securely transmitted to the insurer.

This thorough and multilingual process not only bolsters security but also embraces India’s linguistic diversity, allowing customers to comfortably complete verification in their native language. The robust audit trail, consisting of video and AI-verified photographs, ensures a transparent and reliable record for both the customer and the insurer. Through this, we affirm our commitment to a secure, accessible, and customer-centric verification process.

See It in Action: Ready to elevate your insurance verification process? Schedule a demonstration and see the power of our PIVC solutions in real-time.

The Assisted PIVC Process: Personalized Verification with a Human Touch

Our Assisted PIVC process offers a personal touch to policy verification, with a dedicated agent guiding the customer through each step. Here’s how it unfolds:

- Agent-Led Verification: The process begins with a skilled agent initiating the call, meticulously verifying the customer’s identity, and conducting location and IP checks. This hands-on approach ensures all technical aspects are managed seamlessly by the agent.

- Interactive Questionnaire: During the call, the agent engages the customer with a tailored set of questions. These inquiries delve into important topics such as health history, financial status, and nominee details, ensuring comprehensive data collection for a well-informed policy decision.

- Multilingual Communication: To cater to the diverse linguistic landscape of India, agents proficient in multiple Indian languages conduct the PIVC, ensuring clear and comfortable communication for the customer.

- Documentation and Confirmation: The agent documents the customer’s responses and confirms all the information provided, employing a thorough and empathetic verification process.

The Assisted PIVC process combines the precision of traditional verification methods with the understanding and adaptability of human interaction, offering a personalized experience that technology alone cannot replicate. This approach not only streamlines the verification process but also enriches it with the warmth of personal service, creating a trustworthy and satisfying experience for the customer.

In the intricate world of insurance, trust and precision are paramount. Our Quic PIVC and Assisted PIVC services embody these principles, offering a harmonious blend of technology and personalized assistance. Whether you prefer the swift, AI-driven Quic PIVC or the human-centric Assisted PIVC, we ensure a verification process that’s second to none.

Now, it’s your turn to experience the future of policy verification.

Discover the Difference with a Demo: Don’t just take our word for it. Witness firsthand how our PIVC solutions can transform your policy verification process. Book a live demo with us today and step into a new era of insurance verification.

Find Out How You Can Incorporate Quic PIVC - Pre-Issuance Verification Calling Solution for Insurers

Get your project kick started by filling details below